Medicare donut hole is a fascinating and complex phenomenon within the healthcare system that demands attention. This intriguing concept refers to a coverage gap in Medicare Part D prescription drug plans, and understanding it is crucial for anyone navigating the healthcare landscape. Imagine a scenario where your medication costs suddenly soar, leaving you in a perplexing situation where you have to pay the full price for your prescriptions. This is precisely what the Medicare donut hole entails, and it can have a significant impact on your finances and well-being. Now, you may be wondering, why is this coverage gap even called a “donut hole”? Well, envision a donut: the ring-shaped confection with a delightful void in the center. In a similar fashion, the Medicare donut hole represents the period when your prescription drug costs surpass the initial coverage limit but have not yet reached the threshold for catastrophic coverage. This peculiar gap can leave individuals in a state of vulnerability, facing hefty expenses for vital medications. Understanding the intricacies of the Medicare donut hole is essential for making informed healthcare decisions. By becoming knowledgeable about this topic, you can navigate the system more effectively, potentially saving yourself from unexpected financial burdens. So, delve into the fascinating world of the Medicare donut hole and empower yourself with the knowledge to protect your health and finances.

Medicare Donut Hole: A Comprehensive Overview

| Term | Definition |

|---|---|

| Medicare Donut Hole | The Medicare Donut Hole, also known as the coverage gap, refers to a temporary limit on what Medicare Part D prescription drug plans cover. It is a phase within the Medicare prescription drug coverage where beneficiaries may experience higher out-of-pocket costs for prescription medications. |

| Threshold | |

| Coverage Gap | During the coverage gap, beneficiaries are responsible for a larger portion of their drug costs. This means they will have to pay a percentage of the medication’s cost out-of-pocket until they reach the annual out-of-pocket spending limit. |

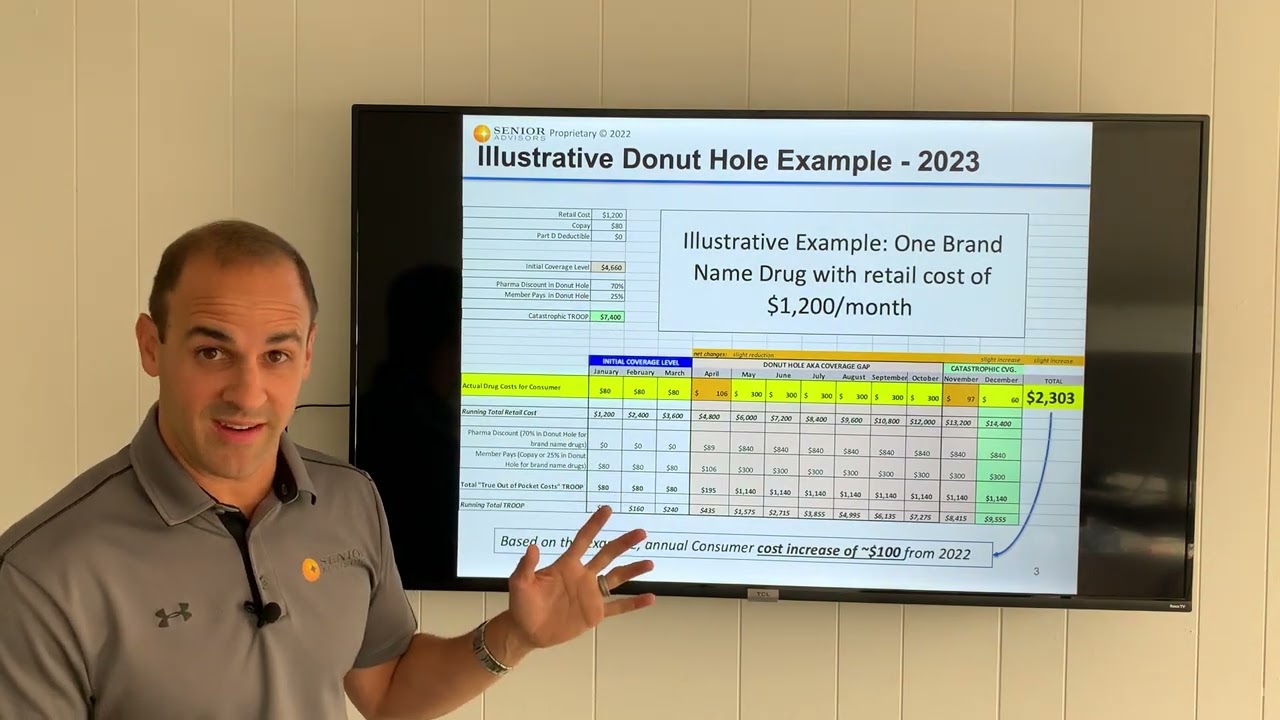

| Discounts on Brand-Name Drugs | Under the Affordable Care Act, beneficiaries in the donut hole receive a discount on brand-name prescription drugs. In 2021, beneficiaries pay no more than 25% of the cost for the drug, while the drug manufacturer covers 70% of the cost. This discount helps reduce the financial burden during this phase. |

| Generic Drug Coverage | While in the donut hole, beneficiaries pay a reduced amount for generic drugs. In 2021, they pay 25% of the drug’s cost, and this amount counts towards their out-of-pocket spending limit. This provision encourages the use of more cost-effective generic medications. |

| Catastrophic Coverage | Once beneficiaries reach the annual out-of-pocket spending limit, they enter the catastrophic coverage phase. During this phase, the costs of prescription drugs decrease significantly, with beneficiaries paying a much lower coinsurance or copayment for the remainder of the year. |

“Revitalizing Medicare: Unveiling the 2023 Transformations and Illuminating the Donut Hole Saga”

Understanding the Medicare Donut Hole

Medicare is a federal health insurance program that provides coverage for individuals aged 65 and older, as well as certain younger individuals with disabilities. While Medicare offers a range of benefits, it also has certain coverage gaps, commonly referred to as the Medicare Donut Hole. This article aims to provide a comprehensive understanding of what the Medicare Donut Hole is and how it affects beneficiaries.

1. What is the Medicare Donut Hole?

The Medicare Donut Hole, also known as the prescription drug coverage gap, is a temporary limit on what Medicare Part D prescription drug plans cover for prescription drugs. It is a coverage gap that exists within the standard Medicare Part D prescription drug benefit.

2. How does the Donut Hole work?

Each year, Medicare beneficiaries enter the Donut Hole once they and their insurance plan have spent a certain amount on prescription drugs. In 2021, this threshold is $4,130. Once the beneficiary reaches this limit, they become responsible for a larger share of their prescription drug costs.

While in the Donut Hole, beneficiaries pay a percentage of the cost of their prescription drugs, including both the drug cost and any dispensing fees. In 2021, beneficiaries pay 25% of the cost of brand-name drugs and 25% of the cost of generic drugs.

3. Closing the Donut Hole

In the past, beneficiaries had to bear a significant portion of their prescription drug costs while in the Donut Hole. However, as a result of the Affordable Care Act, the Donut Hole is gradually closing.

Since 2011, beneficiaries have received discounts on brand-name and generic drugs while in the Donut Hole. These discounts have gradually increased over the years, and by 2020, beneficiaries paid only 25% of the cost for both brand-name and generic drugs while in the coverage gap.

Starting in 2021, the discounts provided by pharmaceutical manufacturers for brand-name drugs in the Donut Hole have increased to 70%, with beneficiaries paying only 25% of the cost. For generic drugs, beneficiaries now pay 25% of the cost, the same as during the initial coverage phase.

4. Catastrophic Coverage

Once a beneficiary’s out-of-pocket spending reaches a certain limit, they exit the Donut Hole and enter the catastrophic coverage phase. In 2021, this threshold is set at $6,550.

During this phase, beneficiaries pay a small coinsurance amount or a copayment for their prescription drugs. These costs are significantly lower than the amount paid while in the Donut Hole. For generic and brand-name drugs, beneficiaries typically pay either 5% of the drug cost or a small copayment, whichever is greater.

5. Strategies to Manage the Donut Hole

There are several strategies that beneficiaries can utilize to manage the Medicare Donut Hole and mitigate its financial impact:

1. Utilize Generic Drugs: Opting for generic drugs whenever possible can help reduce out-of-pocket costs while in the Donut Hole.

2. Explore Patient Assistance Programs: Many pharmaceutical companies offer patient assistance programs that provide discounts or even free medications for eligible individuals in need.

3. Consider Medicare Advantage Plans: These plans often offer additional coverage for prescription drugs, which can help reduce or eliminate the Donut Hole coverage gap.

4. Speak with a Medicare Counselor: Seeking guidance from a Medicare counselor or insurance agent can help beneficiaries better understand their options and make informed decisions.

5. Plan Ahead: Understanding the Medicare Part D prescription drug plans available and their coverage gaps can help beneficiaries plan for potential out-of-pocket expenses in the Donut Hole.

While the Donut Hole is an aspect of Medicare that can cause financial strain for beneficiaries, it is important to remember that it is gradually closing, providing increased discounts and improved coverage. By staying informed and exploring available resources, beneficiaries can navigate the Donut Hole more effectively and ensure they receive the necessary medications without breaking the bank.